Business

Dogecoin, Solana Tokens Lead Gains Among Major Cryptocurrencies

Crypto market capitalization has increased about 4.5% in the past 24 hours after sliding earlier this week.

Crypto market capitalization increased some 4.5% after sliding under $1 trillion earlier this week and touching levels previously seen in early 2021. Bitcoin rebounded to the $21,000 level after a dip to just over $20,000.

Bitcoin reversed Wednesday’s decline even as U.S. Federal Reserve Chair Jerome Powell announced a 75 basis-point interest rate increase, the biggest in over 28 years. The move is part of the Fed’s effort to bring down inflation. The Fed also said it will continue to reduce the size of its balance sheet at the rate announced in May.

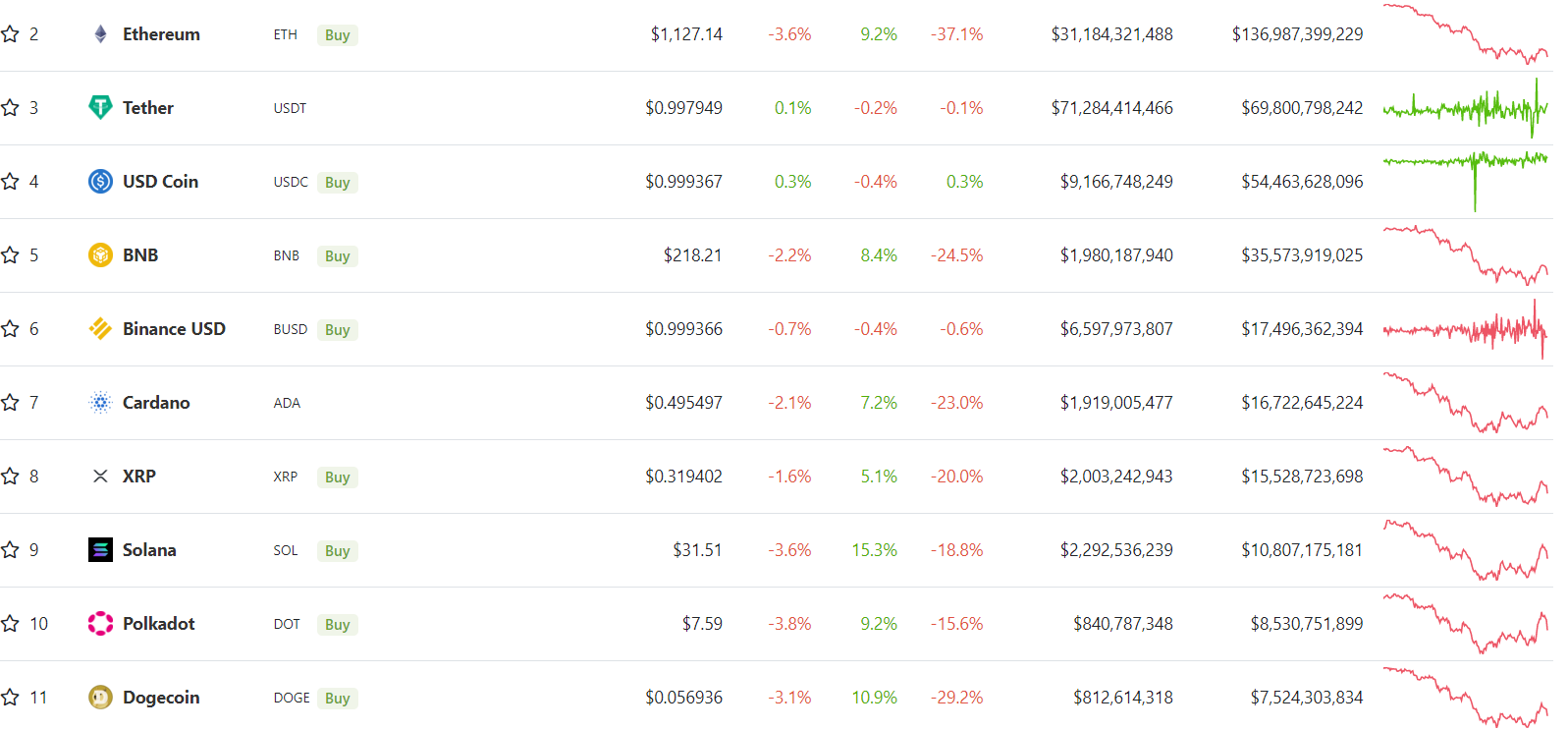

A run in bitcoin and positive sentiment in the broader market saw prices of major cryptocurrencies increase. Ether (ETH) rose 11%, Polkadot’s DOT added 15%, while Cardano’s ADA and XRP rose some 7%, data from CoinGecko show.

Major cryptocurrencies gained in the past 24 hours amid a run in broader markets. (CoinGecko)

Still, some analysts remain skeptical about a sustained rally and said possible contagion risks from within the crypto industry – such as troubles at crypto lender Celsius and crypto fund Three Arrows Capital facing possible insolvency – could add to selling pressure.

“The “don’t fight the Fed” mantra has never been more relevant and volatility is anything but a surprise on the days of the Federal Reserve policy announcements,” Mikkel Morch, executive director at crypto fund ARK36, said in an email. “It seems that last week’s CPI print and subsequent comments by the Fed members already spooked investors so much that by the time of the actual meeting, a 75 basis point rate hike was already largely priced in.”

“It now appears that we can expect the Bitcoin price to hold the $20K level. Likely, it will consolidate there for the foreseeable future and maybe even tag the $24,000 resistance unless there is more contagion risk from one of the troubled projects in the DeFi space,” Morch said.

Outside of majors, Tron’s TRX jumped as much as 27% as the TronDAO, a community-run effort for the future development of Tron, deployed over $220 million to buy the token in the open market to protect the ecosystem’s stablecoin, USDD.

Other notable gainers were Uniswap’s UNI tokens with a 16% gain and tokens of layer 1 protocol Elrond (EGLD) rising 21%. Underperforming tokens included Shiba Inu’s SHIB and KuCoin Shares (KCS), which added less than 5.5%.