Biden stimulus package adds fuel to sweeping stock market shake-up

[ad_1]

This is the second in a series on how Joe Biden’s $1.9tn stimulus plan will affect the US, markets and the global economy.

America’s vast spending programme has added fuel to a powerful upheaval in global stocks, boosting shares in companies that were shunned during the height of the pandemic.

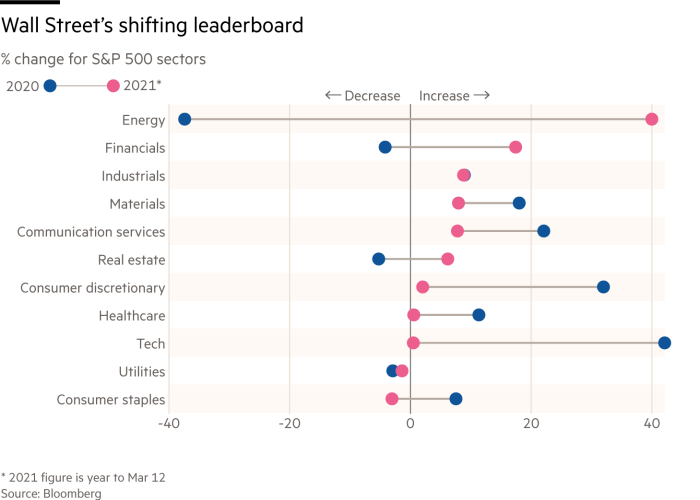

The benchmark US stocks index, the S&P 500, is mostly smoothly pushing higher, as it has done for months. But some tech stocks, in particular, have pulled back hard. Instead, long unloved sectors like banks and energy companies are taking the lead, reordering market dominance on bourses from New York, to London and Frankfurt.

The shake-up suggests that the $1.9tn US spending bill passed by America’s Congress and signed into law by the president last week, combined with vaccine rollouts and the reopening of the world’s major economies, will kick off a markedly different phase in markets to the rally of the past year.

“There’s not all that much going on on the surface but underneath it is violent and ugly,” said Meghan Shue, head of investment strategy at Wilmington Trust.

Investors have piled into banks, which are considered particularly sensitive to fluctuations in the world economy. MSCI’s index of shares in lenders across global developed markets, soared nearly 30 per cent in the final three months of last year and has added another 20 per cent in 2021.

The strong run for banks highlights the shift in investors’ outlook prompted in part by the Biden administration’s plan to pump money into the world’s largest economy and into the pockets of many Americans. The president’s announcement last week that he would seek to bring a sense of normal back to America by July 4 bolstered this perspective.

It has boosted expectations for growth and inflation in the US and around the world, and pushed borrowing costs sharply higher — a boon to banks that had languished as central banks cut interest rates last year to prop up economies after the collapse in output caused by the pandemic.

Investors have also stampeded into sectors such as materials, commodities, consumer goods and industrials in recent weeks, sending prices higher.

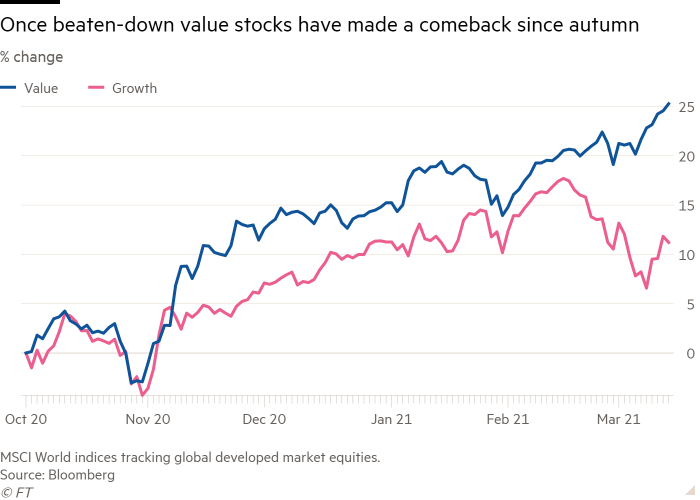

MSCI’s global value index, which tracks companies that trade at low levels compared with measures of their fair value, has risen 8.7 per cent since the start of the year, and reached an all-time high last Thursday. This marks a switch from last year, when the index fell 3.6 per cent, widely trailing an MSCI barometer of rapidly growing companies that soared 33 per cent.

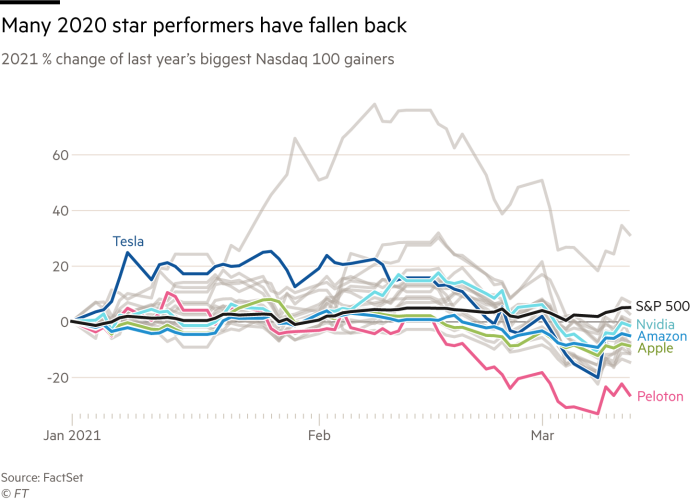

Last year’s star performers like electric carmaker Tesla, at-home fitness group Peloton, tech giant Apple, ecommerce site Amazon and graphics chipmaker NVdia have stumbled from their peaks.

America’s S&P 500 energy, financial, industrial and materials sectors have all shone. That has come as a diverse group of economically-sensitive companies like oil major ExxonMobil, heavy machinery maker Caterpillar, lender Wells Fargo and miner Freeport-McMoRan have recorded lofty gains.

“Last year, growth was scarce and growth stocks were doing well, and now growth is abundant and the most underpriced stocks are the ones that are doing well,” said Juha Seppala, director of macro asset allocation strategy at UBS Asset Management. “This year, that rotation is going to continue and value is going to outperform growth.”

Value funds, which are often heavily invested in some of the sectors that were hit hard in the past year, have also seen a flood of new money. US-domiciled open-ended and exchange-traded value funds tracked by Morningstar Direct recorded $6.3bn in net inflows in February alone, up from $1.3bn in January after almost a full year of net outflows throughout the pandemic. Growth funds sustained $18bn in net outflows in January, before pulling in $3bn in February.

“People rotating out of large-cap growth and momentum and into these more value, cyclical-type factors . . . has definitely ramped up,” said Michael Lewis, head of US equity cash trading at Barclays. “It’s become something that everybody’s focused on in the past two months.”

Juliette Cohen, investment strategist at Paris-based CPR Asset Management, expressed similar optimism about Europe’s old economy companies. “European companies that are exposed to global markets are really exposed to the reopening trade,” she said.

Europe’s Stoxx 600 equity benchmark has risen 6 per cent so far in 2021, putting it within touching distance of its pre-pandemic high last February. The industrial goods and services subsector of the index, comprising companies such as German conglomerate Siemens and aircraft manufacturer Airbus, has risen 8 per cent.

The UK’s FTSE 250, a domestically focused index with heavy weightings of financial, industrial and consumer businesses is “about the purest reopening trade in the world,” added Savvas Savouri, partner and chief economist at London-based hedge fund Toscafund.

The gauge is up 5 per cent in 2021, adding to a climb of around a quarter in the final three months of 2020. “It is all companies that need bodies to be moving around the economy. You’ve got brickmakers, housebuilders, retailers, restaurants. It is literally bricks and mortar,” he said.

Goldman Sachs Asset Management is also looking at pockets in the technology sector to play the reopening trade.

“So, not your Amazons, the Facebooks or Apples, but rather the companies that are making all the chips and make the semiconductors,” said Tim Braude, a senior investment manager at GSAM.

“From our perspective, it’s not too late to get in,” he said about the reopening trade. “We think that we’re just starting.”

Read More